Welcome to The All Memeing Bank!

I am currently in the situation of having more balance than I can find good trading opportunities to bet it in. Therefore, I am in search of users on this site who are in the opposite situation of wanting to take on loans because they find more good trading opportunities than they have balance to invest in.

If you would like a loan, please leave a comment, and I will hopefully respond within a day or two. Initially, I may only offer much smaller loans than others (e.g. 100 mana) to build up lender trust, but I'm usually willing to take a lower interest rate, and the loan size offered may significantly increase as trust improves.

I will use this description as a publicly visible ledger of all past and active loans. At the end of the year I will use this ledger to determine market resolution.

It's possible I'm making a bunch of rookie mistakes given that I've never academically studied finance and I'm pretty much deducing the principles from off the top of my head and from depictions in fictional media, but this is my current train of thought regarding loan interest rates:

Like haggling for a purchase in a street market, as the lender I want the interest rate to be higher and the borrower wants it to be lower. For there to be a possible deal we hopefully have an overlapping range between the worst deals we are each willing to accept (the lowest interest I'll accept vs the highest interest they'll accept). The default situation for purely self-interested agents would be us both trying to convince the other that our limit is stricter than it actually is within that overlap, but if we have a degree of cooperative altruism then we can agree to be transparent and set it at the midpoint of the overlap.

The lowest interest I should be willing to accept is one that leads to expected profit just above what I would otherwise get (currently zero because it's just sitting in my balance, but possibly much more in the future if demand outpaces supply leading to competition from other borrowers), via the interest in cases where it is paid back more than cancelling out losses in cases where it isn't. The probability of payback can be roughly guessed by long term consistency and rate of positive profit growth, as well as explicit track record of paying back loans, good market resolution honesty ratings, and word of mouth from other trusted users. E.g. if I think there's only 25% probability that Tumbles will be able to pay me back by winning their recent big bets or getting bailed out again then the minimum interest rate should probably be about 300%.

Similarly, the highest interest rate it makes sense for the borrower to accept would also give endpoint profit just above what they would otherwise get (if I have a monopoly then zero, but again possibly much more if there's competition from other lenders), via the expected trading profits more than cancelling out the interest. The expected trading profits growth rate per loaned amount might be possible to estimate from their profit and investment graphs.

Train of thought regarding loan sizes and due dates currently in progress.

Active loans:

Date and time: 2025-06-08 00:06 BST (UTC+1)

Recipient: Spin ( @Spin )

Amount lent: 500 mana

Interest rate: 50%

Amount owed: 750 mana

Due date and time: 7d after whenever both the high and low res bean markets have resolved

Loan insurance policy type: 🦝RISK C_100

Loan insurance policy rate: 17%

Loan insurance policy fee: 85 manaUnrealised profit: 250 mana

Date and time: 2025-07-09 08:01 BST (UTC+1)

Recipient: Chumchulum ( @Chumchulum )Amount lent: 100 mana

Interest rate: 4%

Amount owed: 104 mana

Due date and time: 1 month, 2025-08-09 08:01 BST (UTC+1)Unrealised profit: 4 mana

Date and time: 2025-07-22 12:39 BST (UTC+1)

Recipient: For Fold's Sake ( @4fa )

Amount lent: 1000 mana

Interest rate: 4%

Amount owed: 1040 mana

Due date and time: 1 month, 2025-08-22 12:39 BST (UTC+1)

Unrealised profit: 40 mana

Past loans:

Date and time: 2025-04-19 13:06 BST (UTC+1)

Recipient: crowlsyong ( @crowlsyong )

Amount lent: 200 mana

Interest rate: 5%

Amount owed: 210 mana

Due date and time: 1 month, 2025-05-19 13:06 BST (UTC+1)Payback date and time: 2025-04-23 21:43 BST (UTC+1)

Profit: 10 mana

Date and time: 2025-04-30 08:08 BST (UTC+1)

Recipient: Anonymous ( @100Anonymous )

Amount lent: 250 mana

Interest rate: 20%

Amount owed: 300 mana

Due date and time: 1 month, 2025-05-30 08:08 BST (UTC+1)Loan cancellation partial payback date and time: 2025-04-30 08:16 BST (UTC+1)

Loan cancellation partial payback amount: 275 mana

Profit: 25 mana

Date and time: 2025-04-30 06:00 BST (UTC+1)

Recipient: Quroe ( @Quroe )

Amount lent: 500 mana

Interest rate: 4%

Amount owed: 520 mana

Due date and time: 1 month, 2025-05-30 06:00 BST (UTC+1)Payback date and time: 2025-05-01 17:01 BST (UTC+1)

Profit: 20 mana

Date and time: 2025-04-28 22:12 BST (UTC+1)

Recipient: musuko384 ( @musuko384 )

Amount lent: 250 mana

Interest rate: 10%

Amount owed: 275 mana

Due date and time: 1 month, 2025-05-28 22:12 BST (UTC+1)

Payback date and time: 2025-05-01 21:52 BST (UTC+1)Profit: 25 mana

Date and time: 2025-04-15 17:10 BST (UTC+1)

Recipient: kbot ( @kbot )

Amount lent: 100 mana

Interest rate: 4%

Amount owed: 104 mana

Due date and time: 1 month, 2025-05-15 17:10 BST (UTC+1)Payback date and time: 2025-05-15 00:20 BST (UTC+1)

Profit: 4 mana

Date and time: 2025-04-15 15:43 BST (UTC+1)

Recipient: bagelfan ( @bagelfan )

Amount lent: 150 mana

Interest rate: 3%

Amount owed: 154.5 ≈ 155 mana

Due date and time: 1 month, 2025-05-15 15:43 BST (UTC+1)Payback date and time: 2025-05-15 20:11 BST (UTC+1)

Lateness: 4h 28mProfit: 5 mana

Initial date and time: 2025-04-16 14:08 BST (UTC+1)

Recipient: Evan ( @evan )

Initial amount lent: 100 mana

Interest rate: 4%

Initial amount owed: 104 mana

Initial due date and time: 1 month, 2025-05-16 14:08 BST (UTC+1)Revision date and time: 2025-04-30 06:37 BST (UTC+1)

Revised amount lent: 300 mana

Revised amount owed: 312 mana

Revised due date and time: 1 month 2 weeks, 2025-05-30 14:08 BST (UTC+1)

Payback date and time: 2025-05-19 09:08 BST (UTC+1)

Volunteer payee: Anonymous ( @100Anonymous )

Profit: 12 mana

Initial date and time: 2025-04-14 17:00 BST (UTC+1)

Recipient: Robin ( @Robincvgr )

Initial amount lent: 100 mana

Interest rate: 3%

Initial amount owed: 103 mana

Initial due date and time: 1 month, 2025-05-14 17:00 BST (UTC+1)

Revision date and time: 2025-05-01 00:34 BST (UTC+1)Revised amount lent: 300 mana

Revised amount owed: 309 mana

Revised due date and time: 1 month 2 weeks, 2025-05-28 17:00 BST (UTC+1)

Payback date and time: 2025-05-29 02:00 BST (UTC+1)

Lateness: 9hProfit: 9 mana

Initial date and time: 2025-04-17 13:35 BST (UTC+1)

Recipient: For Fold's Sake ( @4fa )

Initial amount lent: 100 mana

Interest rate: 4%

Initial amount owed: 104 mana

Initial due date and time: 1 month, 2025-05-17 13:35 BST (UTC+1)

Revision date and time: 2025-04-30 09:28 BST (UTC+1)Revised amount lent: 300 mana

Revised amount owed: 312 mana

Revised due date and time: 1 month 2 weeks, 2025-05-31 13:35 BST (UTC+1)

Payback date and time: 2025-05-29 10:52 BST (UTC+1)Profit: 12 mana

Date and time: 2025-05-29 20:58 BST (UTC+1)

Recipient: Quroe ( @Quroe )

Amount lent: 800 mana

Interest rate: 4%

Amount owed: 832 mana

Due date and time: 1 month, 2025-06-29 20:58 BST (UTC+1)Payback date and time: 2025-06-11 17:40 BST (UTC+1)

Profit: 32 mana

Date and time: 2025-05-30 18:49 BST (UTC+1)

Recipient: For Fold's Sake ( @4fa )

Amount lent: 800 mana

Interest rate: 3%

Amount owed: 824 mana

Due date and time: 1 month, 2025-06-30 18:49 BST (UTC+1)

Payback date and time: 2025-06-27 18:52 BST (UTC+1)

Profit: 24 mana

Total amount loaned so far

= (300 [Robin] + 150 [bagelfan] + 100 [kbot] + 300 [Evan] + 300 [For Fold's Sake] + 200 [crowlsyong] + 250 [musuko384] + 500 [Quroe] + 250 [Anonymous] + 800 [Quroe] + 800 [For Fold's Sake] + 500 [Spin] + 100 [Chumchulum] + 1000 [For Fold's Sake]) mana

= 5550 mana

Total realised profit so far

= (9 [Robin] + 5 [bagelfan] + 4 [kbot] + 12 [Evan] + 12 [For Fold's Sake] + 10 [crowlsyong] + 25 [musuko384] + 20 [Quroe] + 25 [Anonymous] + 32 [Quroe] + 24 [For Fold's Sake]) mana

= 178 mana

Total profit so far including unrealised profit

= (178 + 250 [Spin] + 4 [Chumchulum] + 40 [For Fold's Sake]) mana

= 472 mana

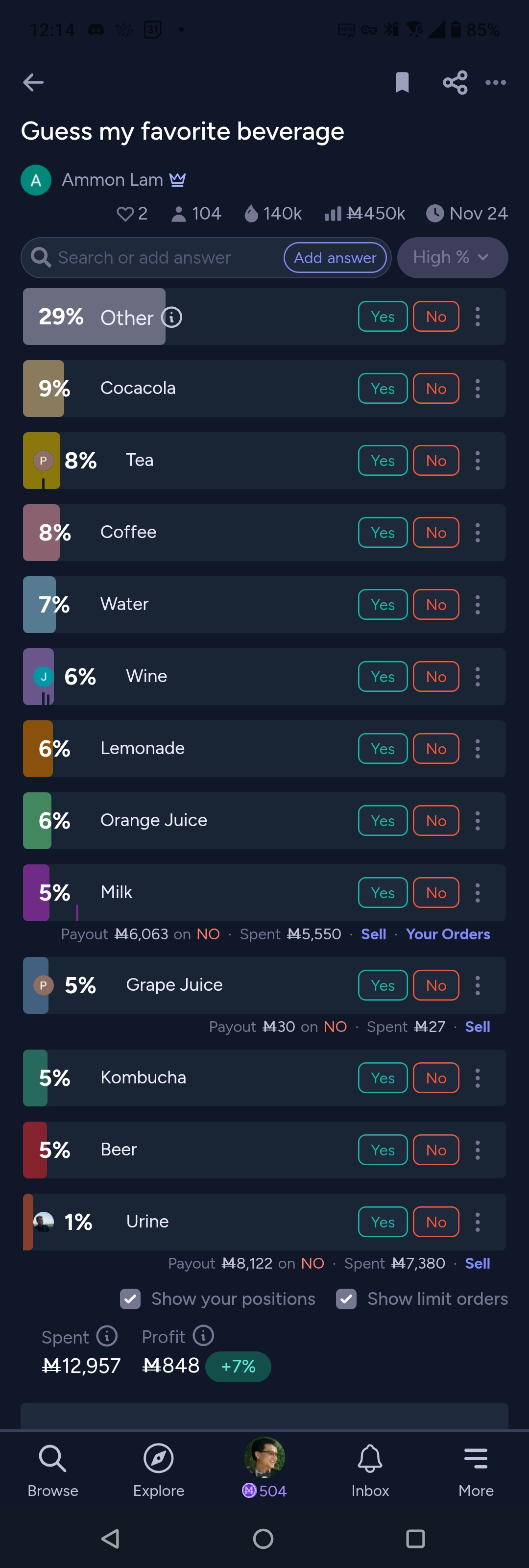

I used most of my balance betting that Ammon Lam doesn't like drinking urine. I need a very short infusion until that resolves on the 24th.

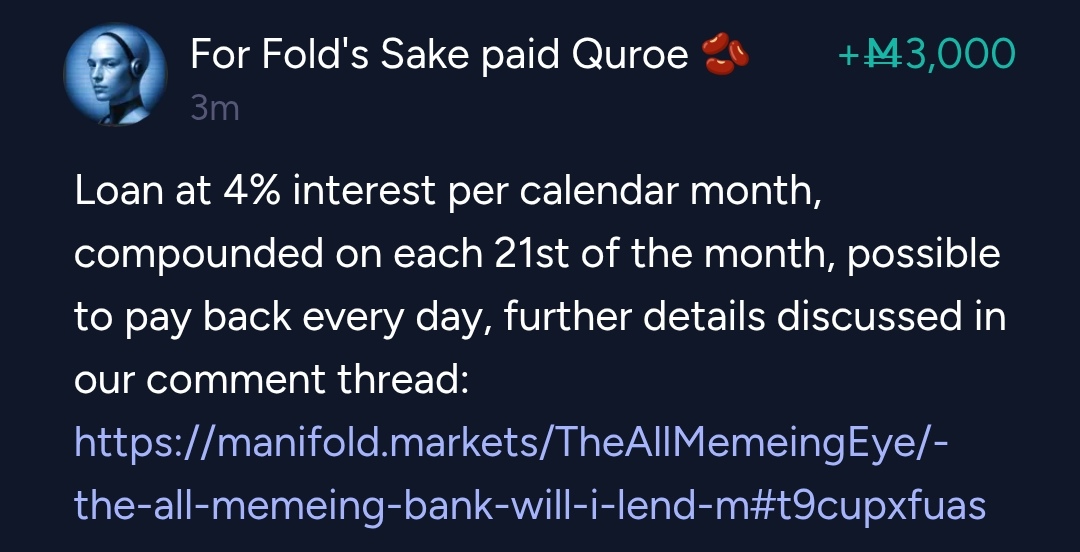

@Quroe I've been authorised to take care of requests while @TheAllMemeingEye isn't online consistently. What conditions did you have in mind?

@4fa I don't need much, is the thing. Maybe something on the order of 1k to 5k mana. My goal is to have some liquidity in my pocket in case I see a random mispriced opportunity in the wild.

My daily loan has an outlook of 861 mana for tomorrow, for reference.

I like to make a point to keep my risk factor low. I am trying to find a way to articulate that I'm asking for the lowest feasible interest rate you'll offer without being too blunt, but I'm failing, so this meta paragraph will have to do.

I intend to pay the loan back basically within a week when that beverage market pays out, but there is a non-zero chance I get blind sighted by a black swan market event and might need to wait for a loan I am servicing to be paid back to me on Dec 15 to pay back this loan from you.

See this post for more details.

@Quroe How about Ṁ3k at your usual interest rate, which would be Ṁ120 / 30 days, so Ṁ4/day? More precisely, the payback amount starts at Ṁ3004 and increases by Ṁ4 each day. In the unlikely event that you cannot pay within 30 days, interest will start compounding.

@4fa I want to be very sure we're using the same language here when you say "compounding". Is it a flat 4 mana per day until the 30 day mark, then the terms change after 30 days? If, in the unlikely event that we get to that point and they do change, what would they change to?

@Quroe Yes to your first question, just flat linear interest during the first 30 days. After that, it will be 4% on the now 3120 mana for the next month / 31 days, this again flat for those 31 days.

How attached are you to your soul? 😈

If, by soul, you mean honor and perceived trust, very highly. It is my prized possession.

@Quroe Edited as promised. Did some calculations and it looks like the compounding effect is mostly cancelled out by the fact that December has 31 days.

@4fa Would that post-30 day interest structure be a daily accrual as well? Or would it just compound for the next month instantly and modify the debt's value as if it were held for another month immediately, and I'd owe that full amount?

Basically, how does this modified debt clock "tick"?

As it stands, I am currently agreeable to this deal. I just want to be thorough and not generate confusion while the loan is live.

@Quroe The first option: Daily accrual, monthly update on the 21st, so 4 mana per day for 30 days, approximately 4.03 mana per day for the next 31 days, and so on…

@4fa Loan repaid! I believe I paid it back correctly, per our agreement. If not, please notify me promptly.

**Special offer**

Mana requested: as much as you're willing to give

Payback date: Jan 1, 2026

Return rate: 50% of the profit I make from what you give me.

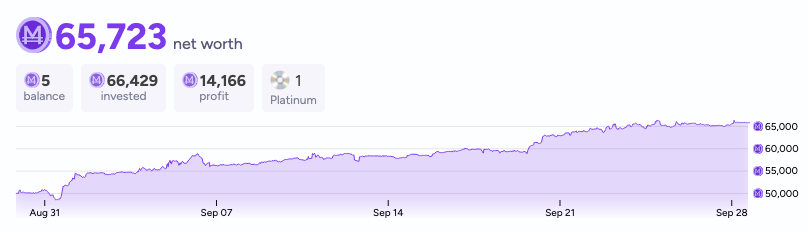

E.g., if my net worth right now is 65k, and you give me 5k, and I make 30k total profit from now til January 1, then I pay you back

5k + 50%*( 30k * ( 5k / ( 65k + 5k ) ) ) = ~6k.

If I make a loss instead of a profit, then I just pay you back the original amount (in this case 5k).

@ItsMe I've been authorised to take care of requests while @TheAllMemeingEye isn't online consistently.

Your RISK credit score looks good! Can we try Ṁ500 for one month at your proposed return rate and then we decide whether to give you another, potentially larger and/or longer loan?

@4fa just to be clear, the profit I make is based on the profit graph, not the net worth. Right now I have 56,500 all-time profit. So if in one month I have 66,500 all-time profit, then I give back

500 + 50%*( 10,000 * ( 500 / ( 65,723 + 500 ) ) ) = ~538.

@Chumchulum I've been authorised to take care of requests while @TheAllMemeingEye isn't online consistently.

Your RISK credit score looks good! Are you still interested?